This white paper was co-authored by Mr. Khan and Ms. Qazi and presented at a 4-day conference on Islamic banking & Finance held in Toronto during 2008.

What is a Mortgage Investment Corporation (MIC)?

A Mortgage Investment Corporation or MIC is a special company created by virtue of Section 130.1 of the Canadian Income Tax Act, to enable investors to invest in a portfolio of mortgages. The portfolio is managed with the invested share capital. The proceeds of discharged mortgages are utilized to fund new mortgages. A MIC offers investors the opportunity to optimize their returns by offering the investment choice of 1st mortgage, 2nd mortgage, and Blended mortgages.

The MIC’s management is responsible for all aspects of the company’s operations including sourcing of suitable mortgage investments, analysis of mortgage applications, negotiation of applicable return rates, terms and conditions, the instruction to solicitors, managing the mortgage portfolio and general administration. Like an investment fund, the MIC’s management is compensated through profit sharing which is based on a pre-determined ratio.

The Canadian tax laws require that 100% of a MIC’s net income, as verified by an external auditor, is be distributed to its shareholders in the form of dividends. The dividend is treated as income earned and therefore taxed at the investors’ end.

Like any other company, a MIC’s net income is equivalent to its revenues less its expenses. A MIC’s revenues comprise primarily of return on mortgages (rental or profit based) and fee income. Expenses comprise primarily of management fees, audit and other professional fees.

The Purpose of a Shariah Compliant MIC

A conventional MIC routes investors’ funds into real estate mortgage portfolios offering stable returns and relatively low-risk profiles. A Shariah-compliant MIC fulfills a similar purpose with due diligence ensuring that the process of the MIC vehicle stays within the framework of Islamic jurisprudence from start to end. The entity for performing due diligence is a Shariah advisory board.

The Shariah-compliant MIC is a need-based product as Muslim investors increasingly look for ways to invest funds in stable portfolios offering higher returns. In Canada, the demand for this product has been community-based and a grassroots initiative.

Elements of a Shariah Compliant MIC

The original nature of a MIC by default is Shariah compliant. In fact, most of its salient features of transparency, accountability, disclosure and profit sharing allow the MIC to be an ideal vehicle for Shariah-compliant investments.

The salient features of a conventional MIC are given below. Some of these features are not a requirement from a Shariah perspective but are required by Canadian tax laws. However, all of these features are in compliance with Shariah.

1. A MIC must have at least 20 shareholders.

2. A MIC’s capital is generally widely held. No shareholder may hold more than 25% of the MIC’s total capital.

3. At least 50% of a MIC’s assets must be comprised of residential mortgages, and/or cash and insured deposits at Canada Deposit Insurance Corporation member financial institutions.

4. A MIC may invest up to 25% of its assets directly in real estate, but may not develop land or engage in construction. This ceiling on real estate holdings does not include real estate acquired as a result of mortgage default.

5. All MIC investments must be in Canada, but a MIC may accept investment capital from outside of Canada.

6. A MIC is a flow-through investment vehicle and distributes 100% of its net income to its shareholders.

7. A MIC may distribute income dividends – typically return from mortgages held and revenue from property holdings, as well as capital gain dividends – typically from disposing of its real estate investments.

8. MIC shares are qualified RRSP and RRIF investments.

9. Dividends received with respect to directly held shares, not held within RRSPs or RRIFs, are taxed as income earned for the shareholder. Dividends may be received in the form of cash or additional shares.

10. A MIC is a tax-exempt corporation.

11. A MIC’s annual financial statements must be audited.

All the above conditions comply with the Income Tax Act, Section 130.1 which governs mortgage investment corporations in Canada.

The flow-through of a Shariah Compliant MIC

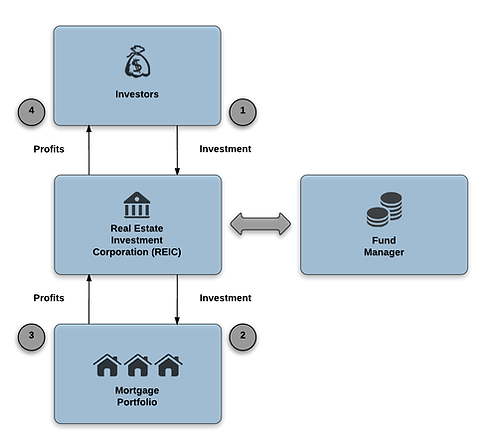

Investors buy shares in a Real Estate Investment Corporation (REIC) and become partnership (Musharakah) shareholders. The REIC acts as a provider of funds (Rab-ul-Maal) and appoints a fund manager (Mudarib). For more information please see our article on Musharakahcontract.

The fund manager invests the funds in a Shariah-compliant mortgage portfolio.

The periodic rental payments are collected from the mortgage pool as profits.

The rental payments are passed on to the investors as profits after deducting the fund manager’s share and the direct expenses for managing the REIC. The profit sharing is based on a pre-determined ratio.

MIC FLOWCHART