The Board consists of three Shariah scholars and four Islamic Finance professionals.

The advisory function of the Board consists of product certification and audit.

A. Product Certification

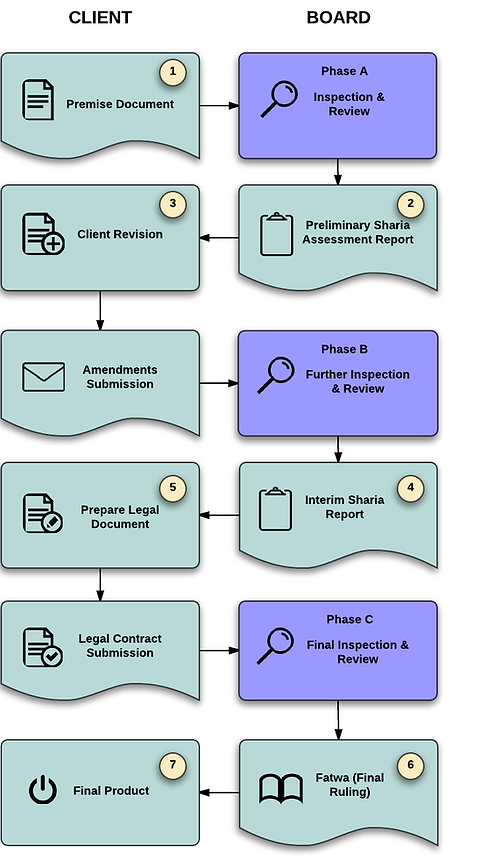

The Board provides certification of financial products based on the following procedure. Please refer to the process flowchart at the bottom of this page.

1. Premise Document

Our clients send us a brief “premise document” describing the objectives, proposed contracts, methodology, and economic impact of the services to be developed for initial review.

2. Preliminary Shariah Assessment Report (PSAR)

IFAB prepares a Preliminary Shariah Assessment Report (PSAR) that identifies Shariah issues, strengths, and weaknesses using a traffic light system of the proposed product and methodology.

3. Client Revision

The clients take the appropriate actions making revisions and amendments to their proposal ensuring Shariah compliance through addressing the concerns raised in the PSAR.

4. Interim Shariah Report (ISR)

Once the document is revised by the client, it is discussed with the Board which scrutinizes it further to ensure that the product and its methodology are completely Shariah-compliant. An Interim Shariah Report (ISR) is produced at this stage with comments from the advisors.

5. Legal Documentation

Once the Board gives a green light, the client prepares legal documentation required for product development. After the legal documentation is completed, it is submitted to the Board for final approval.

6. Fatwa

The final stage involves the approval of the completed product and its structure by the Board that issues a Legal Ruling (Fatwa) on the basis of the information provided by the client.

7. Final Product

The product is now ready to be introduced into the market with the necessary and complete documentation including the fatwa ensuring its compliance.

B. Audit

The Board undertakes the audit of Shariah-compliant service providers to ensure continued compliance over the life of the product. The audits are conducted either on a periodic basis or on a per-request basis. The Board also partners with public accounting firms to provide an audit under the guidelines issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).